Is Electric Car Insurance is more Costly than Combustion engine Car?

In 2022, India turned into the fourth biggest country on the planet by appraisal of the auto business and it adds to around 6.4% of India’s GDP. Yet, the significant test for the business is increasing contamination and high fuel rate, fuel costs in India are exceptionally high (over Rs 100 for every liter) in many pieces of the states.

To shield your pocket from high fuel costs and High ICE Vehicle Maintenance costs, the main arrangement is electric vehicles. Indeed! EVs are financially savvy, discharge zero fossil fuel byproducts, and require no lucrative support. In the event that you as of now have an electric vehicle, congrats you are in a mutually beneficial framework. As you have safeguarded yourself by purchasing an EV and not paying more cash for fuel and upkeep, it is likewise important to check regardless of whether you have taken protection for your electric Vehicles. allow us to comprehend the reason why protection is essential for electric vehicles.

Why protection is significant for electric vehicles in India

Having protection for your electric vehicle will be safeguarded your EV against unplanned harm, normal catastrophes, man-made disasters, on the way harms, and so on. Moreover, the proprietor driver of the guaranteed vehicle is offered an individual mishap cover that safeguards him/her from unintentional injury or passing.

For what reason is electric vehicle protection so costly?

Protection is utilized for monetary security against actual harm coming about because of car accidents and obligation emerging from episodes in the vehicle. Electric vehicle protection is costly contrasted with typical ICE vehicles. it is Due to the battery innovation utilized in EVs, the expense of substitution of the battery is high because of which the insurance payment is higher when contrasted with typical ICE vehicles.

Purposes behind Higher Insurance Premium for Electric Cars?

There are a few purposes behind higher insurance payments for electric vehicles.

- Electric vehicles are extremely light weighted which causes more harm when crashed.

- Electrics vehicle runs on a battery which is exorbitant and has an expiry date so the proprietor replaces the battery before they quit working appropriately.

- Because of high innovation, it requires high support and high gifted work.

The exceptional rates have been fixed at a markdown of 15% when contrasted with different vehicles.

Upsides and downsides of an EV protection

Advantages of Having an Insurance for your Electric Cars

- In the event of a lamentable circumstance where you have made a physical issue an outsider or harmed outsider property, then, at that point, your insurance contract will cover such liabilities.

- A significant piece of the maintenance bill is covered by the insurance agency in the event of fire mishaps, normal disasters, mobs, and misfortunes because of robbery. This implies you don’t need to take care of a costly fix bill if there should be an occurrence of harms.

- If there should arise an occurrence of any vulnerabilities like unintentional passing, substantial wounds, or fractional/absolute inabilities because of a mishap, you will get total monetary remuneration against it.

Burdens of Having an Insurance for your Electric Vehicle

- The cost of electric vehicles when contrasted with typical ICE vehicles is higher due to the high advancements utilized, because of the great worth of electric vehicles, their Insured Declared Value (IDV) increments, bringing about expanded vehicle insurance payments.

- The different parts utilized in the vehicle are exorbitant. The most costly of them is the electric vehicle’s battery, which represents over 60% of its worth. The battery of the vehicle has an expiry date and supplanting or fixing these parts can be an expensive issue, so the proprietor replaces the battery before they quit working appropriately, bringing about expanded vehicle insurance installments.

- All specialists can’t administration or fix electric vehicles, it requires explicit information and abilities. Presently, the quantity of mechanics talented in fixing electric vehicles is lower in India than the customary auto technicians. This large number of variables bring about high work costs for the substitution or fix of electric vehicle parts, and this is another motivation behind why electric vehicle protection plans are costly.

Electric Car Insurance Cost in India?

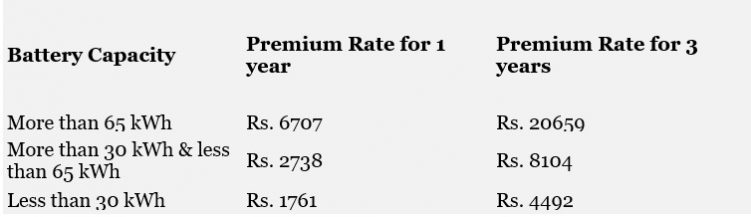

The premium rates for third-party liability insurance are decided by the Insurance Regulatory and Development Authority of India (IRDAI) as a new initiative to boost the adoption of electric vehicles in India. IRDAI has fixed third-party liability insurance premium rates at a 15% discount as compared to petrol/diesel vehicles. Third-party insurance rates are based on battery capacity as mentioned in the table below.

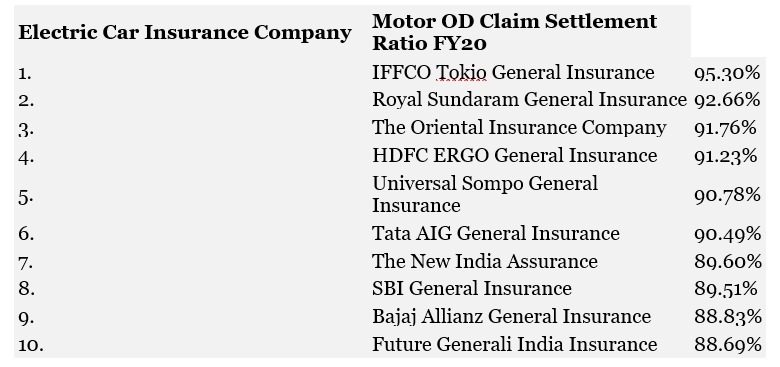

Top 10 Electric Car Insurance Companies in India